It’s the most wonderful time of the year! While almost everyone decks the halls with a Christmas tree and festive decor, you might notice that some of your neighbors have brought their merriment outdoors, with lights on the porch and roof, inflatables, and other lawn decorations. Maybe you are the neighborhood Clark Griswold and have your own, 100,000-watt neon tribute to the holidays from the ridge of your roof to the end of the driveway. But when is too much holiday spirit… too much? When it comes to outdoor decor, it’s best to keep in mind some etiquette rules that will keep your neighbors from wanting to strangle you with a garland sash before 2020.

Don’t put them up early or take them down late.

Although there are no laws mandating the length of “Christmastime” (unless you live in an HOA neighborhood), most agree that holiday lights and decorations should come out no earlier than Black Friday - the day after Thanksgiving - and go back in the attic by mid-January at the latest. I personally take my decorations down on the closest weekend following the Epiphany (January 6th, or the 12th day of Christmas), but everyone has different feelings. If you are truly nutty about the holidays, feel free to put the Christmas tree up the second the last trick-or-treaters leave on October 31st/November 1st, but save the outdoor stuff for late November.

Take your neighbors’ floorplan into consideration.

When stringing up lights, you should have a plan. Make sure that part of that planning includes not hanging lights right across from your neighbor’s bedroom window. You should always be considerate to the fact that your outdoor display might be a nuisance to others. The front of the house is generally fair game, but don’t be that guy who insists on decking out the backyard (unless it’s for a one-night Christmas party on the back porch). Also consider the brightness of your lights. The new LED strands are blue-white, which is especially blinding, and you don’t want your neighbor temporarily impaired when pulling out of the driveway.

Don’t indirectly invite the whole city.

Some neighborhoods are known for their elaborate light displays, to the point that visitors will pay by the car to drive through and sip cocoa as they appreciate the spectacle. Odds are, however, that if you are reading this, you don’t live in one of those places. In general, people like Christmas lights and driving around to look at them. It’s even a tradition in some families. And the larger and more gaudy your lights are, the more likely it is that your address will get passed around as a must-see stop on folks’ light tour. If this gets too crazy, your neighbors could be dealing with excessive traffic trying to get home after work, and that makes you the bad guy.

Be the change you want to see in the world.

If you are on the opposite end of the holiday light debate and have a neighbor who goes nuts with wooden reindeer, multiple inflatable hula-dancing Santas, and enough lights to power Rhode Island, try to practice patience unless their display blocks visibility when you are pulling out or otherwise goes beyond a nuisance. It is in fact supposed to be a season of joy and goodwill towards your fellow man, so try not to harsh anyone else’s good time. Merry Christmas and Happy Holidays!

If you can afford to hire a moving company when your family relocates, by all means, you should. Trying to move yourself, even with the help of some friends and/or family members, is ultra-stressful, incredibly time-consuming, and the biggest of logistical headaches. Money spent on movers will save you not only time and physical labor, but also on stress and hardship on your belongings. But movers aren’t magicians: you can’t just walk out the old house with no preparation and expect to saunter over to your new home in the blink of an eye. In fact, there are things you can and should do to help your movers. These tips are not just out of common courtesy, but meant to save you money.

If you can afford to hire a moving company when your family relocates, by all means, you should. Trying to move yourself, even with the help of some friends and/or family members, is ultra-stressful, incredibly time-consuming, and the biggest of logistical headaches. Money spent on movers will save you not only time and physical labor, but also on stress and hardship on your belongings. But movers aren’t magicians: you can’t just walk out the old house with no preparation and expect to saunter over to your new home in the blink of an eye. In fact, there are things you can and should do to help your movers. These tips are not just out of common courtesy, but meant to save you money.  Book-lovers, let’s talk organization. How do you arrange your books? Shelves, crates, bookcase? Do you organize by author, subject/genre, or even by color? (I’m silently judging you if this is your choice... Just kidding.) Are you a fellow book hoarder, with hundreds of volumes stacked up on every flat surface in your home? Or do you prefer a pared-down arrangement that showcases your very favorite titles? Vertical or horizontal stacks? Every reader has preferences.

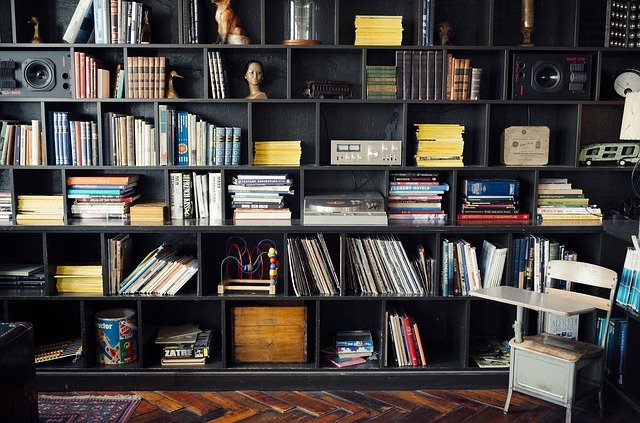

Book-lovers, let’s talk organization. How do you arrange your books? Shelves, crates, bookcase? Do you organize by author, subject/genre, or even by color? (I’m silently judging you if this is your choice... Just kidding.) Are you a fellow book hoarder, with hundreds of volumes stacked up on every flat surface in your home? Or do you prefer a pared-down arrangement that showcases your very favorite titles? Vertical or horizontal stacks? Every reader has preferences. The kitchen is one area of the home that homeowners always wish was fancier, no matter how well-off they are. Well, almost. I’m sure that there are about five percent of owners who either have custom kitchens the size of my whole downstairs or are slackers who just order pizza every night, neither of whom are complaining. But if you are stuck in the rut of a galley kitchen with shelves that are too high to reach without a rickety stepladder, not enough counter space, and very little glam, then an aspirational kitchen is a common fantasy. After all, the kitchen is the heart of the home. We cook there, we eat there (maybe only certain meals), and we celebrate there. If you’re embarking on a fancy-kitchen journey, there are some fixtures and elements that will take your cooking space from “eh” to “WOW.” Read about them here.

The kitchen is one area of the home that homeowners always wish was fancier, no matter how well-off they are. Well, almost. I’m sure that there are about five percent of owners who either have custom kitchens the size of my whole downstairs or are slackers who just order pizza every night, neither of whom are complaining. But if you are stuck in the rut of a galley kitchen with shelves that are too high to reach without a rickety stepladder, not enough counter space, and very little glam, then an aspirational kitchen is a common fantasy. After all, the kitchen is the heart of the home. We cook there, we eat there (maybe only certain meals), and we celebrate there. If you’re embarking on a fancy-kitchen journey, there are some fixtures and elements that will take your cooking space from “eh” to “WOW.” Read about them here. It’s more than just a design buzzword: hygge (an untranslatable Danish word that is a combination concept of cozy, warm, inviting, and homey) is a way of life. As the winter winds bring their harshest chills to Northern Virginia, make like the great Danes and transform your home into an oasis of tranquility with just a few simple touches. And, in case you wondered, it’s pronounced HOO-gah or HUE-gah.

It’s more than just a design buzzword: hygge (an untranslatable Danish word that is a combination concept of cozy, warm, inviting, and homey) is a way of life. As the winter winds bring their harshest chills to Northern Virginia, make like the great Danes and transform your home into an oasis of tranquility with just a few simple touches. And, in case you wondered, it’s pronounced HOO-gah or HUE-gah. Life in a studio is all fine and cozy until you want to have a guest - or, heaven forbid, more than one - over. All of the sudden, the wide-open floor plan and lack of dividing walls can make things awkward, especially when it comes to obscuring your sleeping space. The following are a few tried-and-true tricks for creating division within your studio to make your sleeping space more private.

Life in a studio is all fine and cozy until you want to have a guest - or, heaven forbid, more than one - over. All of the sudden, the wide-open floor plan and lack of dividing walls can make things awkward, especially when it comes to obscuring your sleeping space. The following are a few tried-and-true tricks for creating division within your studio to make your sleeping space more private.  The holiday season officially kicks off next week with Thanksgiving, a holiday that’s all about togetherness and gratitude. When everything comes together, at the risk of sounding corny, you will feel the much-touted warmth of family and friends gathered together “as the fates allow.” This is a time when even home sellers and buyers take a break and celebrate the season. A great Thanksgiving has a lot of moving parts, and it’s really not a one-person job. You’ll want decorations, a tablescape worthy of the ‘Gram, and of course, delicious food. To make sure that everything goes off without a hitch, avoid these common Thanksgiving mistakes. One of these wrong moves and your holiday will be more akin to a disaster.

The holiday season officially kicks off next week with Thanksgiving, a holiday that’s all about togetherness and gratitude. When everything comes together, at the risk of sounding corny, you will feel the much-touted warmth of family and friends gathered together “as the fates allow.” This is a time when even home sellers and buyers take a break and celebrate the season. A great Thanksgiving has a lot of moving parts, and it’s really not a one-person job. You’ll want decorations, a tablescape worthy of the ‘Gram, and of course, delicious food. To make sure that everything goes off without a hitch, avoid these common Thanksgiving mistakes. One of these wrong moves and your holiday will be more akin to a disaster.  People are visually stimulated. Never is this the case more than when shopping for a home. It’s estimated that 90 percent of people start their home search online, checking for listings that they think are attractive before going to an agent. And also, in a similar majority of cases, prospective buyers can tell by the first thumbnail (not even a click!) if they are interested in the house or not.

People are visually stimulated. Never is this the case more than when shopping for a home. It’s estimated that 90 percent of people start their home search online, checking for listings that they think are attractive before going to an agent. And also, in a similar majority of cases, prospective buyers can tell by the first thumbnail (not even a click!) if they are interested in the house or not. Staging your home for an open house can be a very daunting concept. Should you paint? Should you hire a company to replace all your furniture until you move out? SHOULD YOU KNOCK DOWN A WALL? Take a deep breath,

Staging your home for an open house can be a very daunting concept. Should you paint? Should you hire a company to replace all your furniture until you move out? SHOULD YOU KNOCK DOWN A WALL? Take a deep breath,